Henry Paulson, architect of USA TARP bailout, on prospect of Trump USA presidency

Last modified on 28th June 2016

There may be some readers who dislike former USA Treasury Secretary, Henry Paulson, for his role in the TARP bailout. [To me it seems that he (and his team) did a heroic job of initiating the rescue of the USA from the financial crisis that threatened it bigtime. Tim Geithner followed up as his successor to Treasury secretary, and continued with the heroic work (along with his team). Mind you, all the TARP bailout money (tax payer money) loaned to USA companies by the USA government has been REPAID IN FULL to the USA govt. This part does not seem to get much publicity in the current political discourse in the USA.]

Here's his, very knowledgeable from a top level USA finance and economy point of view, take about the prospect of a Mr. Trump USA presidency. [It is very critical of Trump. When I come across a suitable rebuttal of this article by Trump or his surrogates/supporters, I will put up a link to it here.]

When it comes to Trump, a Republican Treasury secretary says: Choose country over party, https://www.washingtonpost.com/opinions/when-it-comes-to-trump-a-republican-treasury-secretary-says-choose-country-over-party/2016/06/24/c7bdba34-3942-11e6-8f7c-d4c723a2becb_story.html, dated June 24th 2016.

A few short extracts from it:

Republicans stand at a crossroads. With Donald Trump as the presumptive presidential nominee, we are witnessing a populist hijacking of one of the United States’ great political parties. The GOP, in putting Trump at the top of the ticket, is endorsing a brand of populism rooted in ignorance, prejudice, fear and isolationism. This troubles me deeply as a Republican, but it troubles me even more as an American. Enough is enough. It’s time to put country before party and say it together: Never Trump.

...

I can’t help but wonder what would have happened if a divisive character such as Trump were president during the 2008 financial crisis, at a time when leadership, compromise and careful analysis were critical. The only reason we avoided another Great Depression was because Republicans and Democrats joined together to vote for the Troubled Asset Relief Program — a vote that they knew would be politically unpopular but in the best interest of our country. Critical to that effort was the leadership of President George W. Bush. As I led Treasury’s efforts to fashion a difficult, imperfect, controversial but essential solution with bipartisan support, I was — and still am — grateful to have had President Bush at the helm.

---- end short extracts from washingtonpost.com article ---

Ravi: As I have read Tim Geithner's book, Stress Test (the scariest book I have read in my entire adult life), I tend to agree with the second extract given above. I know some readers may vehemently disagree with me, but that's OK. Maybe I am wrong - but that's my view as of now.

[Here's my review of Geithner's Stress Test book, Very educative book on global financial crisis 07-08 and aftermath; Krugman is not-so-positive about the book, 9 August 2014, http://www.amazon.in/review/RZO3WQJ7YHBDQ]

=====================================================

Given below are some of my comments from my Facebook post, https://www.facebook.com/ravi.s.iyer.7/posts/1758203077729595, associated with this blog post:

In response to a comment giving a link to the Rolling Stone article, Secrets and Lies of the Bailout, http://www.rollingstone.com/politics/news/secret-and-lies-of-the-bailout-20130104, by Matt Taibbi, dated January 4th, 2013, I (Ravi) wrote (slightly edited):

Thanks a ton for the contrary view, --name-snipped--. I will read the longish article later and get back to you with my humble views. I have to say that I expected a strong comment from you on this post :-), but am glad that you have given me reading material which I think would be supportive of your contrary view.

---

I (Ravi) wrote:

Just read the wiki page of the article author, https://en.wikipedia.org/wiki/Matt_Taibbi. Seems to have made a name for himself for controversial stuff. However, I will carefully read what he says about the biggest crisis in my adult lifetime (the USA financial crisis of 2007-08 with global ramifications), without being prejudiced in my reading.

-----

I (Ravi) wrote:

Read most of the long Rolling Stone article by Matt Taibbi. He finds a lot of faults with the Paulson-Geithner-Summers rescue plan and implementation over the years 2008 to 2012 or so. But I don't think he gives a good alternative plan.

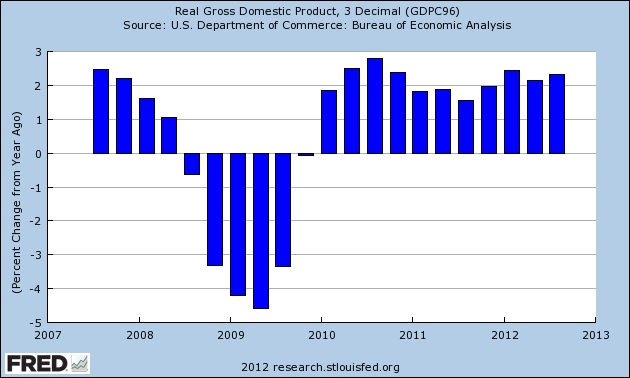

Here's some data which I think gives the picture of the recovery the US economy made with the rescue plan and implementation. https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiTk8wNnQ2Magdp08eblpmrX2NpKrzz7rz_oF70LAEZTE3hZr_OR_jqf2MqmwoHtfqstQLOpcPtJtbh0H8i6nEKejmlbxiEjf1rbaG5fI2LDOP2WUC5uEBDcu6ec4i-hmH8Iej9xTyjHq8/s1600/GDP+2.png. Same image is given below.

From the plunging GDP growth in 2008 to recession (negative growth) till around end 2009, and then positive GDP growth from 2010 onwards, the data does give a positive view of the rescue plan and implementation. Now if you doubt the govt. supplied data itself as lies then we cannot have a discussion at all! I do believe that the USA govt. would not blatantly lie about key data like GDP growth (minor fudging to present a positive view may be happening but not outright false data).

I think authors like Matt Taibbi seem to be of the view that the govt. lies about anything and everything. With such a view, one becomes deeply cynical and completely distrustful of the govt. I have not read about respected and knowledgeable columnists like the economist and Nobel laureate Paul Krugman (writes for the New York Times) having such views of key USA govt. data (like GDP growth/decline numbers). I prefer to go by Paul Krugman's views rather than the views of Matt Taibbi on this matter (of having some level of trust in USA govt. GDP data).

Now Paul Krugman too has been critical of some of the work that Geithner did. Krugman felt that far more should have been done. From his review, http://www.nybooks.com/articles/2014/07/10/geithner-does-he-pass-test/, "America did indeed manage to avoid a full replay of the Great Depression—an achievement for which Geithner implicitly claims much of the credit, and with some justification. We did not, however, avoid economic disaster. By any plausible accounting, we’ve lost trillions of dollars’ worth of goods and services that we could and should have produced; millions of Americans have lost their jobs, their homes, and their dreams. Call it the Lesser Depression—not as bad as the 1930s, but still a terrible thing. Not to mention the disastrous consequences abroad."

I find such criticism by Krugman to be a lot more balanced than that of Taibbi.

HAMP like Taibbi pointed out was a failure. The bonuses that got paid to bailed out bank executives was an outrage!

An extract from my review of Stress Test, http://www.amazon.in/review/RZO3WQJ7YHBDQ:

I think I can pitch in with my view that I tend to agree with Krugman on, "Whatever Geithner may say, it’s clear that a lot more could also have been done to reduce the burden of mortgage debt". The book has US president Obama telling Geithner about letters he gets from families who are getting devastated with their mortgage payments and asks Geithner why can't we do more to help such people. The book mentions the HAMP intiative, http://en.wikipedia.org/wiki/Home_Affordable_Modification_Program, but acknowledges that it did not do a great job. The wiki page includes scathing criticism of HAMP: "HAMP has proven a colossal failure that has done more to harm than help debt-laden homeowners. Having only achieved slightly more than 500,000 permanent modifications, 40% of which the Treasury expects to default, HAMP has fallen dramatically short of its goal of helping 3 to 4 million homeowners avoid foreclosure."

Given the fact that loan waivers for farmers in India are quite a common affair, when the US President was so keen on bailing out debt-laden homeowners, I think the US treasury department under Geithner should have figured out a way to provide significant debt-relief to them. I mean they could have introduced a new act and few elected politicians would have dared to oppose it as many of their own constituents would have benefited. I am quite sure that the judiciary too would have backed any act/law helping out the devastated debt-laden homeowners. The world was watching the incredible and shocking sight of these debt-laden homeowners of the USA suffer (with some even becoming homeless and living in a car or in a desolate park/street, while many houses were empty) while AIG executives earned million dollar bonuses after the company received huge tax payer money bailout! From http://en.wikipedia.org/wiki/AIG_bonus_payments_controversy:

President Barack Obama said, "[I]t’s hard to understand how derivative traders at AIG warranted any bonuses, much less $165 million in extra pay. How do they justify this outrage to the taxpayers who are keeping the company afloat?" and "In the last six months, AIG has received substantial sums from the U.S. Treasury. I’ve asked Secretary Geithner to use that leverage and pursue every legal avenue to block these bonuses and make the American taxpayers whole."

...

AIG has defended the bonuses by citing contractual obligations.[citation needed] AIG also claims that only their executives can unwind their complex derivative deals. Rick Newman of US News & World Report argues that this is tantamount to extortion.[46] MSNBC host David Shuster said "The argument that these were so-called retention bonuses is undermined by the fact that 52 of the people who received them have already left the company."[10]

--- end wiki extract ---

That Geithner and the US treasury department couldn't deliver on bailing out debt-laden homeowners and were powerless in preventing the tax-payer bailed out AIG bonuses, must be viewed as a glaring and deeply distressing failure of the US government, and of democracy as a whole.

--- end extract from my (Ravi's) review of Stress Test ---

Ravi: Stress Test, from what I recall of it. gives a chilling account of how bad things got once Lehman Bros. collapsed. I don't know what exposure you have had to the top financial world --name-snipped--, but Lehman Bros. was one of the pillars of the THEN one and only superpower, the USA! For people like me who have not directly worked in the financial software services market but have friends who have worked there and have a general idea about how much financial power these giants had, Lehman Bros. collapsing was UNTHINKABLE! That Citi, AIG, Goldman Sachs, Merrill Lynch etc. were all in big trouble then (as covered by the book, Stress Test) was TERRIFYING! I mean, if all of these giant global financial companies would have collapsed, the entire world would have lost faith in the USA Dollar and the USA backed world financial institutions like the World Bank and the IMF. That would have brought in a period of chaos in world business. Yes, the world would have come up with some alternatives to the US Dollar and USA backed financial institutions like World Bank and IMF, but it would have been traumatic and what would have emerged would have been a rush-rush solution. Today, in 2016, alternatives backed by countries like China, South Africa, Brazil and India, are there in some form.

Now, it is in period of great financial turmoil that political (and sometimes military) upheavals take place. Hitler's rise to power in Germany preceded a period of great financial turmoil in Germany then. What history teaches us is that such great financial turmoil could lead to instability (breakdown of law & order) within the country, and possible wars outside as a desperate way to solve the problems a country is facing. The USA THEN being the ONE AND ONLY SUPERPOWER could have landed into great instability within and perhaps put into power somebody who attempted to use USA's military might to force its way out of problems. [Today too, the USA is the only superpower but many of the other powers in the world are somewhat prepared for a 2008 type USA situation both from a financial perspective, and, frankly, it seems to me, from a military perspective as well. The USA is no longer considered as an infallible world financial power.]

I consider Henry Paulson, Tim Geithner and their teams as heroes as they somehow avoided the catastrophic situations that I have mentioned above. Their work may have had some flaws and may still be incomplete. But I don't agree with the view that they were failures and were crooks who duped the USA citizens. I don't think one should say that Paulson and Geithner are financial crooks UNLESS one has evidence to prove that they used TARP bailout money for their personal gain (which is the kind of line that Taibbi seems to take, even if he may not have made such a specific charge against them). However, you seem to have a different view (more aligned to Taibbi's views, I guess). We can politely agree to disagree on this one, brother --name-snipped--. Thanks.

----

I (Ravi) wrote:

I should add that the persons who did the real unethical things were the guys who were fooling USA citizens into going for sub-prime loans and mortgages. Is there evidence that Henry Paulson and Tim Geithner encouraged such practices? They were regulators, I believe. They could be questioned on how such practices escaped their notice, and how such practices should be prevented in future. But if they did not encourage such unethical and bad practices (sub-prime stuff), my view is that they should not be held accountable. It is the guys who did the sub-prime stuff who should be held accountable.

-----

In response to a comment, I (Ravi) wrote:

I think there is very little doubt, if any, that big money plays a huge role in USA democratic politics and therefore USA governance. I think that is the case with Indian democratic politics and governance too though the Indian situation is different with caste and religion associated politics playing a predominant role in most elections across the country (barring urban areas).

Senator Bernie Sanders has done a great service to democracy worldwide (including India) by putting a relentless spotlight on big money politics favouring the few to the detriment of the many, backed by SHOCKING data about the hollowing out of the middle class of the USA. [It is the middle class of the USA that I believe is recognized to be the main people power that brought the USA extraordinary success in various fields of endevaour including, of course, raw financial power, over the past century or two. For instance, the leading lights in the software and hardware revolutions that have come about in the world in the past half century or so have been mainly middle class type NERDs, some of whom became business risk-takers and founded world-changing companies from Hewlett-Packard & Apple (home garage origin, if I recall correctly) to Microsoft to Yahoo & Google & Facebook. Even the giant companies in the history of computing like IBM and AT&T have had middle class type NERDs who brought in the major game-changing innovations in the hardware & software field. It has been my privilege to have had some correspondence in the past few years with one or two of the leading lights of the (international) software field over decades (not business founders and so not millionaire/billionaire types as far as I know), and know from that correspondence how decent these guys are. The seem to be middle class types and good guys - surely not elitists seeking any kind of world dominance. Essentially, they are gifted folks who want to contribute to make the world a better place.]

Very interestingly, all the current contenders in the USA presidential campaign (Clinton, Trump & Sanders) have acknowledged the hollowing out of the middle class and that this must be addressed. They have different proposed solutions to the issue - but none of them dispute the hollowing out of the USA middle classes and how that is a very unhappy and unsatisfactory situation.

Regarding the financial crisis of 2008, perhaps you are not aware of how serious the situation was. I think Senator Sanders said that the TARP bailout was a mistake and that the big banks & financial investment companies in big trouble, should have been allowed to fail then. I think you may be having the same view. Perhaps Senator Sanders is right.

But the book, Stress Test, showed how dangerous the situation had become. I don't recall the specific scenarios that were considered imminent if the bailout was not done and faith in those big banks and financial institutions not bolstered by the public knowledge that the USA govt. was going to support them and not allow them to fail. But the scenarios may have been bank ATMs not dispensing cash in most places in the USA, supplies of various goods & services to the USA being reduced or halted completely by suppliers who were worried about getting paid by USA companies/govt. (USA then was extraordinarily dependent on many goods & services from other countries, which satisfy basic needs of USA people like clothing, medicines, oil & gas to keep the vehicles running on the roads) etc. ... Hurricane Katrina not only hit New Orleans badly but resulted in a kind of breakdown of law & order at that time with survival challenges for the residents till serious help arrived. Such breakdown of law & order and survival challenges may have got played out across many parts of the USA then if financial titans like Citi, AIG, Goldman Sachs and Merrill Lynch had collapsed quickly following Lehman Bros. collapse. If you think I am being wildly imaginative in considering that these things could have really happened, just do some reading up on what is happening in Venezuela today.

The USA govt. managed to prevent such horrific scenarios with the TARP bailout though it could have done better especially in terms of help to home owners struggling under the bad sub-prime mortgages that they had been saddled with by unscrupulous home financing companies.

Now the work to be done is to rein in big money in democratic politics & governance which is what all the three USA presidential contenders have publicly spoken in favour of. Senator Sanders' proposal to break up too big to fail banks & financial institutions, seems to me to be a good proposal at its core. However, it should be pursued in a gradual manner in consultation with experts from economy and finance fields, to prevent any dangerous shocks to the system.

Very importantly, the tens of trillions of dollars of debt that the USA govt. has raked up, and which seems to be on the road of becoming even more bloated in the future, must be reined in. Yes, the USA economy is big but even its debt to GDP ratio is at dangerous levels of over 100%. Just have a look at the map at the top of this wiki page, https://en.wikipedia.org/wiki/Debt-to-GDP_ratio, to see how the USA fares in debt to GDP ratio in comparison to other countries of the world. That sort of debt burden seems to be unsustainable which could lead to another, perhaps worse, USA financial crisis. Further, and I think this is a very vital point, such kind of growing debt burden seems to be putting some of the next generation(s) of USA citizens in a gloom-and-doom mindset. That kind of fatalistic resignation to a bleak future can be very negative for them and for the USA. So the USA must put its financial house in order and not MAX out its credit cards like there is no tomorrow. Strong words from me, perhaps. But I have done a lot of reading up and viewing up on this stuff and these words come from that background. A lot of top USA political leaders in the know about such matters have publicly said something on similar lines though not using the graphic words that I have. Hope you don't mind my having used these strong words.

Finally, let me drop my PUBLICLY neutral stand on USA presidential election for a minute here. One of your comments was, "I now understand why you aren't a Bernie Sanders fan! Hillary is much better aligned with this thinking and maybe Trump too." I have already expressed my unstinting praise for Senator Sanders' extraordinary work in putting the spotlight on big money influence in USA democratic politics. But I do have concerns about his understanding and capability in administering/governing USA economy including its financial sector. His proposals (e.g. funding free college through tax on Wall Street speculation) seem to be airy-fairy to me. Perhaps I am wrong and he is a genius in economy and finance, and so will have the ability to deliver on the many freebie promises that he has made, if he does become USA president. But I would tend to lay more value to his words if he had a track record of doing something similar at a USA state governor level - Mayor of Burlington would not have given the exposure to big economy and finance issues that a USA state governor would have had. On these economy & finance matters, I do feel that both Hillary Clinton and Donald Trump have more knowledge than Bernie Sanders. However, that does not mean that I endorse the economy and finance related plans of Hillary Clinton or Donald Trump - I have not really studied them to have a proper opinion on it.

Based on their public speeches I have the view that Trump has got some things right in terms of the diagnosis of the problems facing the USA economy but in his speeches he does not seem to have articulated well enough how he will fix those problems. Perhaps his campaign website has details - I do not have the time or inclination to get into that level of detail. Hillary Clinton's speeches have not dwelled upon the bulging USA debt (even in relation to its GDP), as far as I know (in stark contrast to Donald Trump and some other Republican candidates who dropped out, in particular, Senator Rand Paul and Dr. Ben Carson). So I really don't know what her campaign's plan is to reduce USA debt to manageable levels.

-----

[Ravi: I have given below the Sept. 2012 World Debt to GDP ratio map from abovementioned wiki link]

----

I (Ravi) wrote in response to a comment:

Will read the linked articles later ... wanted to respond to main body of your comment right away. I do recognize that my "airy-fairy" term (I had not read Clinton campaign usage of such a term; my usage was independent of that as far as I can recall) is loose as I have not put in the time to study the details of Senator Sanders' economic plan. So, as I wrote in my comment immediately after my "airy-fairy" term usage sentence, "Perhaps I am wrong and he is a genius in economy and finance, and so will have the ability to deliver on the many freebie promises that he has made, if he does become USA president."

But my remark is based on what he said in public speeches/debate when questioned on it, that the money would come from a tax on Wall Street speculation. That, frankly, sounds quite naive to me. As I have mentioned before, these guys would move the speculation deals part to London or Hong Kong or elsewhere. That would be quite easy to do, IMHO. It is not like opening a new factory in Europe or Asia or South America - it would be far, far easier to do, I think.

Would a President Sanders then have the authority/ability to jail Wall Street guys who moved the speculation work to London or Hong Kong to avoid the new taxes that President Sanders imposed on such activity? I strongly doubt it. That would need complex new legislation which I think would need to pass USA Congress who may not be so eager to support such legislation.

But then, as I said before, maybe I am wrong. A President Sanders may be able to succeed in taxing Wall Street speculation and getting enough revenue from that to fund free college education across the USA (to USA citizens).

The student loan crisis of the USA is horrific and, very unfortunately, some sections of Indian higher education (e.g. engineering, management and medicine) are going in the same direction. I have blogged about it in my Indian CS & IT academic reform activism blog. So, yes, I am well aware of the serious student loan crisis in the USA.

About Hillary Clinton's solution to college debt crisis: I don't think she has promised free college education in the USA, has she? She does have some proposals to tackle the college debt crisis but I have not studied them in detail. If Hillary Clinton has promised free college education in the USA then I will spend the time to study her proposal for funding it and giving my view on it.

As we are on the topic of college education, I would like to add that I am very disappointed to see the high costs involved in college education in the USA as well as, for some areas in higher education, in India. I don't see any realistic solutions for it happening in the near term future either in the USA or in India. Instead, I see hope in alternative Internet based higher education initiatives like Udacity, https://www.udacity.com/, who offer short term skill oriented degrees called Nanodegrees which are tied with some kind of a job guarantee, and at reasonable cost (as compared to regular college costs). I believe that initially Udacity was operating only in the USA. Recently they have started operations in India too.

To summarize, I believe that solution to high costs, and so student debt crisis, in college/higher education will come from revolutionary impact type innovation in the methods used to impart that education, using the Internet, rather than from governments or brick-and-mortar classroom based universities and colleges.

----

I (Ravi) wrote in response to a comment (edited):

I think I have had enough top-level exposure to the high costs issue of US higher education and associated student debt crisis, to have an overview understanding of the problem and the largely unsuccessful attempts made at combating the problem. Perhaps you are aware of more details than I do. But the issue at hand is not details of the problem but viability of solutions that presidential candidates have proposed to solve the problem.

Firstly, I wonder whether you are aware of the Obama administration's efforts to solve the problem. One of my earliest blog posts on the matter is dated Dec. 2011, http://eklavyasai.blogspot.in/2011/12/affordable-subject-wise-certification.html. (I started blogging about Indian CS & IT academic reform activism in August of 2011). An extract from that post:

US President Obama meets US university presidents to address/discuss their challenges: http://www.economist.com/node/21541398

The article talks of the problems of rising costs in an age of austerity, more courses & more research students than there is money for and interestingly, Ivy league envy. "Ivy League envy leads to an obsession with research.", it states. This results in professors who are focused on research and don't do their job of teaching students well enough, and even causes teaching dysfunction at lower-level universities!

--- end extract from my blog post ---

Ravi: I also felt it appropriate to share an extract from The Economist article linked above (University challenge by Schumpeter, http://www.economist.com/node/21541398, dated Dec. 10th 2011):

Anger about the cost of college extends from the preppiest of parents to the grungiest of Occupiers. Mr Obama is trying to channel the anger, to avoid being sideswiped by it. The White House invitation complained that costs have trebled in the past three decades. Arne Duncan, the secretary of education, has urged universities to address costs with “much greater urgency”.

A sense of urgency is justified: ex-students have debts approaching $1 trillion.

--- end short extract from The Economist ---

Ravi: Around four and a half years have passed since the above Economist article was published. Obama and secretary of Education, Arne Duncan's, passionate efforts to get USA University presidents (conveyed in a meeting at the White House!) to reduce higher education costs and solve the student debt crisis problem seem to have not delivered results.

I have already expressed my scepticism at Senator Sanders' proposed solution to the USA student debt crisis problem. While I have not studied details of Secretary Clinton or Mr. Trump's proposed solutions to this problem, I would be quite surprised, and pleasantly surprised, if they are able to solve the problem.

The part about Sanders' campaign promises to create new rules and/or legislation to prevent/reduce tax dodging by companies, sounds good. Trump has talked about this aspect too. Don't know if the Clinton campaign has a stand on it. In general, my view is that companies and individuals must pay their fair share of taxes, and tax evasion/dodging should be strongly discouraged by suitable tax laws.

--------------------------------------

Please note that I have a PUBLICLY NEUTRAL informal-student-observer role in these posts that I put up about the USA presidential elections. Of course, as I am an Indian citizen living in India, there is no question of me voting in these elections.

[I thank washingtonpost.com, Paul Krugman & nybooks.com, stlouisfed.org, economist.com and wikipedia, and have presumed that they will not have any objections to me sharing the above short extracts from their website on this post which is freely viewable by all, and does not have any financial profit motive whatsoever.]

Comments

Post a Comment